Financial Management Best Practices for Islamic Schools

Sound financial management is essential for the sustainability and growth of Islamic educational institutions. Whether you're running a small weekend program or a full-time Islamic school, implementing best practices can ensure your institution thrives.

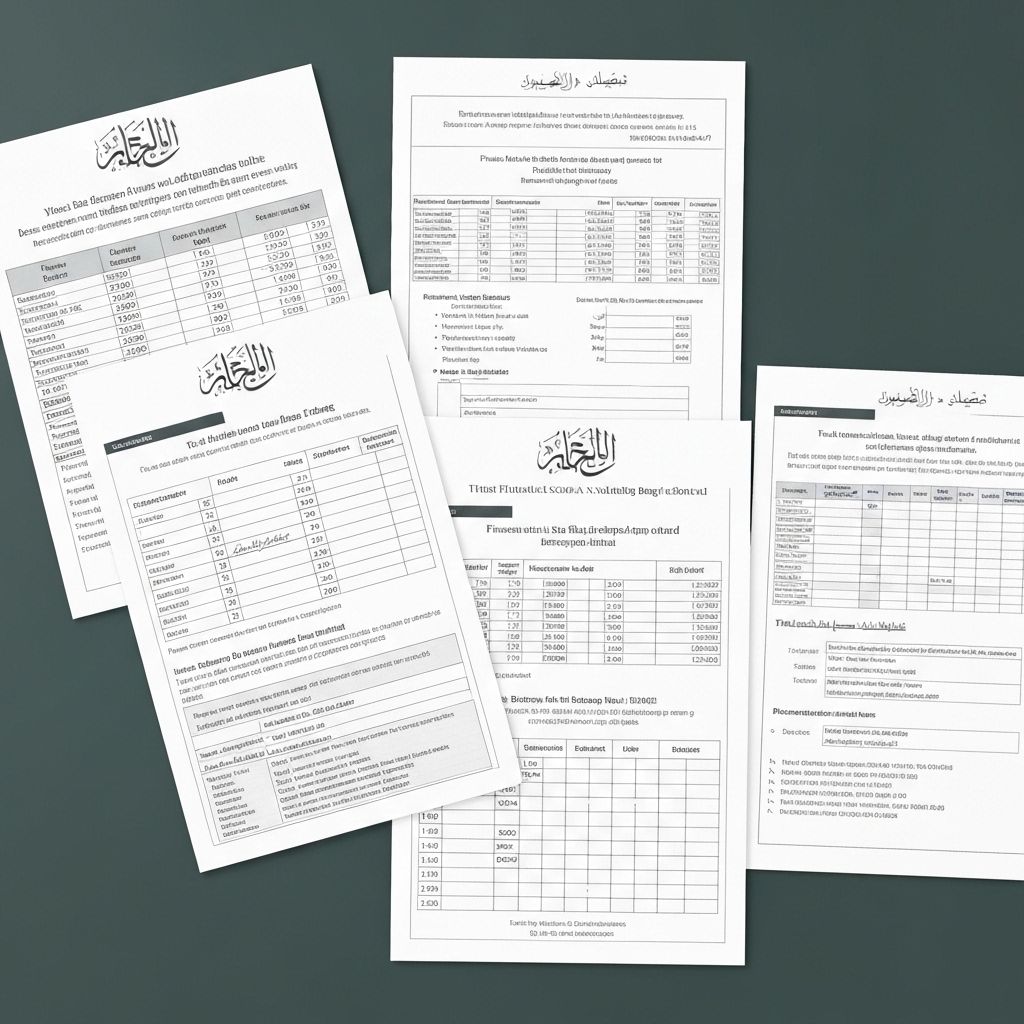

Transparent Tuition Management

Clear, upfront communication about tuition and fees builds trust with families. Implement a transparent fee structure with no hidden costs, and provide multiple payment options to accommodate different family situations.

Donation and Zakat Tracking

Many Islamic institutions rely on community support through donations and zakat. Proper tracking and acknowledgment of these contributions is both a legal requirement and a matter of trust. Automated receipt generation and proper categorization simplify this process.

Compliance and Reporting

Non-profit Islamic institutions must comply with local regulations regarding financial reporting and tax receipts. Implementing systems that automatically generate compliant documentation saves time and reduces errors.

Budget Planning

Effective budgeting requires understanding your institution's financial patterns. Track income and expenses by category, identify seasonal trends, and plan for both expected and unexpected costs.

Financial Transparency

Regular financial reports to your board and community demonstrate accountability and build confidence. Consider quarterly summaries that show how funds are being used to advance your educational mission.